We are now 1 week past an election that produced major records.

Donald Trump produces biggest popular vote count by a Republican ever, New York Post, Nov 10 ‘24

Trump Wins Arizona, sweeping all seven battleground states, Edison Research says, Reuters, Nov 9 ‘24

While I could write a lot about this election, an election that I was involved in more than any in my life, it is time to return to markets. My comments will focus not on where markets could be next year, but what the technical picture is currently, 1 week after the election.

Bitcoin

[Source: Zero Hedge, Nov 11, 2024]

Bitcoin Hits Record High as Trump Sparks Bull Run of a Lifetime - Here’s What You Must Do, Doug Casey International Man, 11/11/24 (free email to those signing up/this is merely a piece of information for your thinking, nothing more, anyone holding cryptos knows this is a highly volatile market)

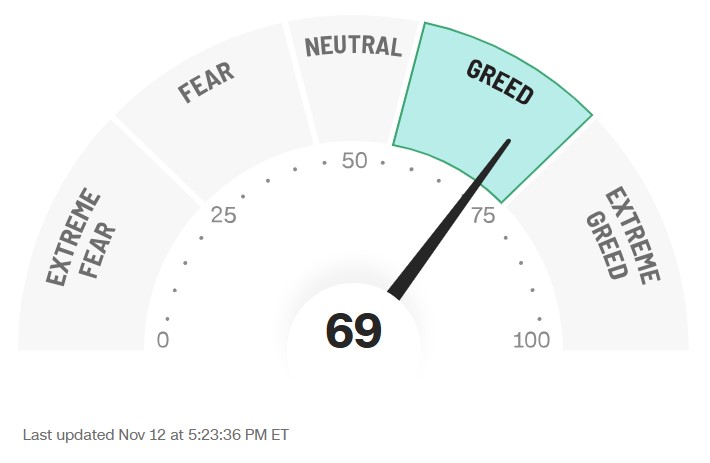

While the headlines and commentary drive our emotions, for me, I must return to fear and greed indicators for the overall market. Based on this indicator, and what we have lived through since last October, what would you do?

[Source: Coin Market Cap Crypto Fear and Greed Index, 11.12.24]

Bitcoin has moved like a rocket since the US Presidential elections last Tuesday. With Trump being the first president to support Bitcoin and the crypto community, the reaction should not be a surprise.

[Source: Coin Market Cap Crypto Fear and Greed Index, 11.5.24]

These changes in one week are what all investors looking to buy Bitcoin must consider. None of us know what will happen in the next 7 days, however, we do know from the fear and greed data in the August post, Deep Dive Markets: What Can be Learned from Fear, that very low readings ( Sept ’23 and early Aug ’24) and very high readings (March ’24), gave us signals of an extreme and a probable change of direction was near.

So today, November 12th, I DO know that this crypto fear and greed index is showing a reading of 86, and I DO know that its highest reading in 2024 was 92 was on March 11. I also know that when this indicator was at 30 or under, it coincided with a low point for buying Bitcoin.

The next point that must be considered beyond this indicator, is what has changed at the foundational level of this market that did not exist when we started this year.

In 2024, we saw some of the largest money managers in the world launch exchange traded funds (ETF) based on the price of Bitcoin and Ethereum. [Too Big to Stop: Big Money Launches Bitcoin ETFs, Jan 12’24]

It was the first time a president or presidential candidate spoke at an annual Bitcoin conference. [Donald Trump Bitcoin 2024 Keynote Speech, July 27 ’24, You Tube]

As I write this post, I find this article from Forbes: The U.S. Government Is One Step Closer to Holding 1 Million Bitcoins, 11/11/24.

The new Chair of the Senate Banking Committee is likely to be Senator Tim Scott (R-SC), the current Ranking Member. Sen Scott appeared on stage with Sen Lummis at Bitcoin Nashville, and he is likely to bring the BITCOIN Act to a vote in committee early in the 119th Congress.

While we must respect the fear and greed index when buying or selling in any market, the foundational changes we have watched unfold in 2024 are a first in history. Based on the low of 2023 being the start of wave 1 in a larger trend based on Elliot Wave Theory - developed by Ralph Nelson Elliot, an accountant living through the throes of the Great Depression - the developments since the August 3rd low [chart above] supports the theory that this is a 3rd wave in a larger 5 wave move up. A pull back after this rocket move in the last week would be perfectly normal.

At this point, if you are going to get in or add to a position, the best strategy is to ease in over days or possible the next few weeks. It is also very important to remember this is a very volatile part of your portfolio, and should be considered speculative.

The Larger Stock Markets – Some Steam Needs to Let Off

At this stage, I am still waiting for something to happen with the NASDAQ. While it leaped last week, creating 2 gaps on the way up, it has now stalled for 3 days.

The parabolic move up in the Dow with today’s sell off, is another index I continue to watch closely. A pull back down to the 50 day or 100 day moving average could be possible in the near term.

In the meantime, we do know that things have changed since the July 10th high which led to the sharp drop we saw into August 5th.

Notice in the NDX 100 chart dated 11/12/24, that the CNN Fear and Greed Index reached 69 today. As you can see, it reached 57 on 7/10/24. This does not tell us it will start a sharp drop immediately, but it does tell us that we should not be surprised if it does.

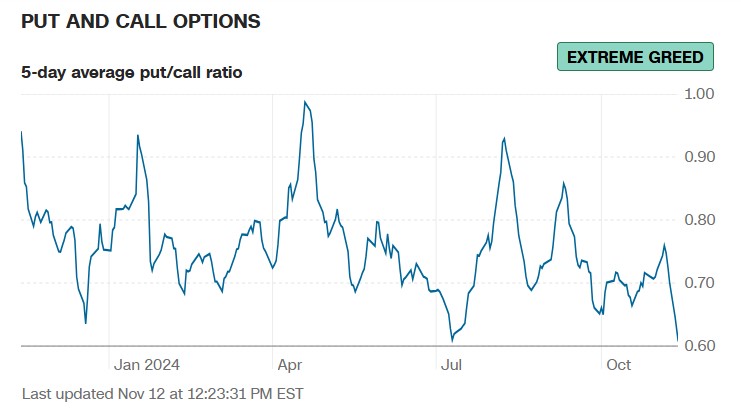

Also, the put/call ratio - an excellent way to read leveraged shorter term trading money - hit a bullish reading (more calls than puts, or long positions than shorts) that was the same as the 7/10 reading this year. As a contrarian, this should always be seen as a warning sign to a possible turn of direction.

[Source: CNN Fear and Greed Index, 11/12/24]

Gold and Silver. Correction in Major Bull Market

US debt, 10 Year Treasuries

The final thing on my list of charts today is the 10-year US Treasury, and a chart of the interest payments being made by the US government.

Notice that yields start CLIMBING the day the Federal Reserve started their interest rate cuts on September 18th! So much for controlling the larger debt markets and interest rates.

The last dip you see in this picture where the interest payments on the US debt takes a pause, is 2020 when COVID hit. After that, we can see that US interest payments on our debt (US Treasuries) have increased to almost DOUBLE what they were in 2020. This requires every investor and advisor to understand that major changes are ahead.

These are not trading comments, these are things that impact the larger economic and financial picture.

Conclusion

As we move through the final weeks of 2024, I encourage you to enjoy every day. I cannot fix these huge issues, but neither have I ever expected to see these huge problems fixed. This is where every person must eventually come to look at the world through a spiritual lens.

We have grown to believe that when it comes to money, central banks will always have the answer with more money printing, a belief that has been drilled into our heads since we came off the gold standard in 1972.

As I go into this Christmas, my passion from studying the Bible over 50 years has grown richer and stronger. To me, the story is clear. God is in control, and only He will ever make things stable after men fail.

“Ordinary people have the ability to not think about things they do not want to think about” Blaise Pascal

If you have a question or would like to make a comment, please post it below. You can also respond by using the group email that alerted you to this post.

As always, please share with others if you find this of value. Thanks.

Disclaimer: Best Minds Inc was closed in 2018. I am retired. Nothing I am writing should be taken as advice to buy or sell any form of security or asset. Everyone must study and consider their own situation before putting money anywhere, as well as understand they are living in a time where major changes at the highest levels of money are taking place. These writings are free.

Comments